2025

- The issuance of Sustainability-Linked Unsecured Bonds for US$800 million is announced.

- FUNO and AXO achieve the world’s first LEED® O+M v5 BETA certification for the industrial logistics facility Nave Industrial 2 at the TLALNEPARK IV complex.

- The successful issuance of a Sustainability-Linked Unsecured Bond in the local market for MXN 12.7 billion is announced.

- FUNO announces the implementation of the internalization of the Real Estate Advisory and Representation Agreement.

- The successful carve-out of all its industrial assets is completed through the formation of a joint venture (Next Properties) with Fibra NEXT.

Centrum Park, Edo. México

2024

- Successful issuance of the Senior Unsecured Green Bond in international markets is completed for US $600 million.

- Full acquisition of the MÍtikah project is completed with the purchase of 100% of the CKD Helios for a total of Ps. $7 million.

- FUNO is positioned as the trust with the largest IFC EDGE-certified real estate portfolio in the world.

- FUNO reaches 68% of LEED-certified square meters in the country, where Mexico is in the 6th position globally.

- Tlalnepark IV and Torre Diana become the first properties worldwide to be certified under LEED O+M V5 Beta, both owned by FUNO.

Centrum Park, Edo. México

2023

- FUNO announces a successful sustainability linked bond issuance in the local market for Ps. $6,700 million.

- Announces the extension of its committed sustainability linked revolving credit facility for Us $1.2 billion.

- Announces the final certification of Mítikah Ciudad Viva which is the first retail mixed used project in latin america to receive the EDGE certification.

- FUNO becomes the first mexican reit to get its science-based targets validated.

- FUNO announces the issuance of a sustainability linked bond for Ps. $1,500 million and the payment of FUNO 13-2 bond for Ps. $3,120 million.

Mítikah, CDMX

2022

- FUNO is invited by the IFC (International Finance Corporation) to be part of the "EDGE Champions" group of companies.

- Torre Cuarzo, Punta Santa Fe and Torre Mexicana receive LEED O+M Gold level certification.

- For the second consecutive year, FUNO is included in the S&P/BMV Total Mexico ESG.

- We successfully refinanced bank loans related to our Titan and Vermont portfolios for a total of US. 720 million, with the possibility of extending to US. 750 million.

Torre Cuarzo, CDMX

2021

- We acquired the Memorial Portfolio, consisting of 16 properties.

- We sold two properties and a commercial lot for a total amount of $733.4 million Mexican pesos.

- FUNO is included in S&P’s 2021 Sustainability Directory, positioned in the top 15% of global companies with best practices on Environmental, Social Responsibility and Corporate Governance within the Real Estate segment.

- Successful reopening of its unsecured vouchers with expiration in 2026, for a total amount of $300 million USD.

- Collocation of the first sustainable unsecured vouchers issued by a Mexican REIT on the national market for $8.1 billion pesos.

Gayosso, CDMX

2020

- We acquired 6 Hercules properties and an expansion in Lago III.

- FUNO sells 98.8 million USD in properties.

- We rebought 2% of CBFIs (77,027,606 in circulation).

- In December we repaid the revolving credit facility willed in April corresponding to 6.75 billion pesos and 205 million USD.

- FUNO issues debt bonds for 650 million USD.

- Thanks to our portfolio diversification, we managed to relieve COVID-19’s economic impact and maintained our solidity.

Tlanepark II, EDO de México

2019

- We acquired the Titan portfolio, which added 74 industrial warehouses to our properties, which helped FUNO reach a GLA of 10.1 million m².

- We placed unsecured vouchers in the international market for 1 billion USD.

- FUNO is included for the 2nd year in a row in the Sustainability Index (FTSE4Good) of the London Exchange Market.

- We were included in the Dow Jones for Emerging Markets Sustainability Index.

- FUNO remains for the 2nd year in a row in the Sustainability Index DJSI MILA.

San Martín Obispo II, EDO de México

2018

- FUNO issues bonds for 9.2 billion pesos approximately.

- FUNO is included in the Sustainability Index DJSI MILA for the 2nd year in a row.

- We consolidated our participation in 70% of the Torre Mayor in Mexico City.

- FUNO announces the opening of Midtown Jalisco, a mixed-use development in Guadalajara, Jal.

Midtown, Jalisco

2017

- FUNO holds its 4th subsequent public offering.

- We acquired Apolo II, Turbo & Frimax portfolios.

- We carried out bond issuance locally.

Tlanepark II, Edo de México

2016

- We had two bond issuances, one in Mexico and another one in international markets.

- Acquisition of Torre Cuarzo, Hospital Puerta de Hierro, El Salto, Midtown Jalisco and Alamar.

- FUNO implements its environmental and sustainability strategy 100% internally.

- FUNO formalizes its co-investment with HELIOS for the development of the new Mítikah project in the south of Mexico City.

Tlanepark II, EDO de México

2015

- We created HELIOS. The first real estate development vehicle of its kind in Mexico, designed to execute large-scale and mixed uses projects for long gestation periods.

- We acquired Kansas, Indiana, Florida, Utah, Oregon, Bufalo, Alaska and Hotel Vallarta portfolios.

- FUNO becomes the 1st REIT to obtain an unsecured, committed and dual-currency credit line.

Torre Caballito, CDMX

2014

- FUNO conducts its 3rd follow-on equity offering, this one being the biggest 4th issuance made by a Mexican company.

- FUNO enters international debt markets and becomes the first REIT in the world to issue a 30-year bond on its debut.

- Apolo’s operative platform and a cutting-edge Oracle system are incorporated.

- Acquisition of Samara, Hilton Centro Historico, La Viga & California portfolio.

Samara, CDMX

2013

- FUNO conducts its 2nd follow-on equity offering.

- FUNO makes its debut on local debt markets, issuing a 10-year bond.

- Acquisition of Apolo, Vermont, Colorado, P8, G30 & Torre Diana portfolios.

- The Apolo acquisition represents the largest and most important real estate transaction in Mexico: 23 million pesos.

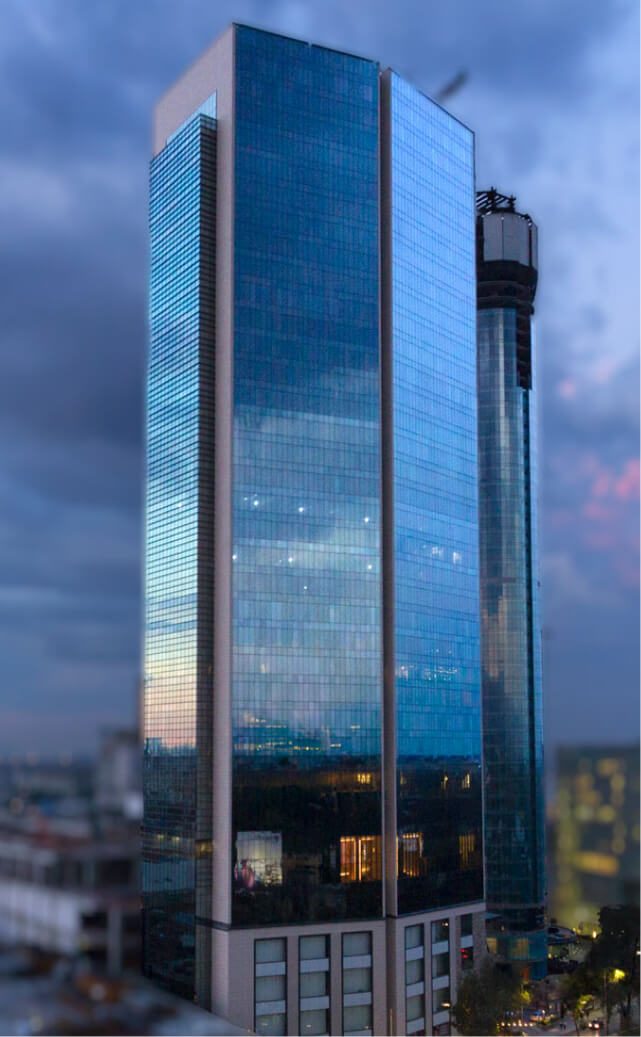

Torre Diana, CDMX

2012

- FUNO conducts its 1st follow-on equity offering.

- We acquired Morado, Verde, Blanco, Gris & Rojo portfolios.

- Acquisition of Torre Mayor.

- FUNO closes its first third-party acquisition: the Azul portfolio.

Torre Mayor, CDMX

2011

- FUNO starts as the first REIT of Mexico.

- We initiated with a portfolio of 13 properties.

- We were the first real estate company to be listed in the Mexican Stock Exchange.

- We had our first initial public offer.